Is Elon Just Trying to Get Twitter at a Discount?

12 Jul 2022

BUCK: Elon Musk may still purchase Twitter, we think, possibly, maybe. We’ll get into some of that in a moment here. There are some pretty, I think, outlandish claims being made by people about the process of trying to buy one of the biggest social media platforms out there. Here is David Faber over at CNBC.

Clay, I want to just break this part of it down for a second and then talk about what the bigger dynamics are here. And then Elon and Trump going a little back-and-forth. That was interesting. You got some heavyweights taking some online slugs at each other. But here is CNBC’s David Faber. Play this one.

FABER: They have specific performance in the contract. They are going to have a Delaware judge enforce that contract and say, “These are the reasons why.” Most of the people that you speak with, certainly that I have, believe that that, in fact, will be the case. Then the question is, “Well, okay. You’re forcing Mr. Musk to buy the company. Does he actually agree to do it?” There’s this argument being said lately that, well, maybe he won’t comply with that. Well, then we’d have a situation, they could put him in jail.

Where do they find these imbeciles? David Faber: Elon Musk Could Go to Jail Over Twitter Dispute https://t.co/0C4EgOwipz

— WindTalker (@nmlinguaphile) July 11, 2022

BUCK: Put him in jail? They’re gonna put him in jail? Clay, what is this?

CLAY: Yeah, look. There’s no way that this is going to lead to jail time. I also don’t believe in specific performance. For those of you out there who are not familiar with the legal concept of specific performance, sometimes — Buck, you bought houses over the years — if you sign a contract to buy a house, and then you try to back out of it — depending what that deal might look like from a contractual perspective — you might be required to specifically perform.

And/or the person who agreed to sell is it to you might be required to specific to perform because we, for instance, consider real estate to be so unique that it’s not easy to replicate somewhere else. I’ve never heard of someone being required… I think David Faber is hundred percent wrong here. I’ve never heard of specific performance being applied as it pertains to a $44 billion purchase.

What I believe is likely to happen is this thing is going to go into court; there are gonna be a lot of lawyers that make a lot of money, Buck. It’s good to be on this case if you’re a lawyer. But they’re going to reach some form of compromise below the $54.20-per-share purchase price. I think Elon Musk gonna get a discount based on some of the things that he’s uncovered surrounding the Twitter business, ’cause I don’t think Twitter has a lot of options here. And if you look at the stock price it is back up $1.40 today, suggesting — suggesting — that maybe there’s going to be… $54.20 was the purchase price, maybe they agree at $42 purchase price, I think that’s the most likely outcome here, 40, 42, 38, something like that.

BUCK: Yeah. There are people are saying that Elon’s concern over the bots — the computer programs posing as actual accounts all over Twitter — and that there are too many and that that affects the value. And I’m sure that’s true, but I think it’s also true that he was way overpaying in that initial offer for what Twitter is actually worth as a company — and it’s fascinating, I think, when you think back to how the initial reaction of the Twitter board and CEO was, “Oh, my gosh! This is so horrible!

“It’s like Attila the Hun is invading and taking us over.” You know, it’s this terrible thing. When they were getting… This is like if somebody says, “Hey, your house is worth 250K, I’ll give you 500 for it,” and you’re like, “How dare you, sir!” It’s crazy how they reacted to his top-dollar offer. It just goes to show you how ideologically invested the current management is in this company staying as a province of the woke left and staying as a tilted playing field for Democrats.

CLAY: Yeah. And, Buck, I think it’s also emblematic of — to your point on the overevaluation of Twitter. So many stocks and companies have tanked as a result of the Joe Biden inflation and all of the challenges currently existing in our economy right now. It’s funny how quickly Twitter went from, “Oh, this is an existential threat to our company,” to now suing, demanding that Elon Musk purchase the company for the price that he agreed to buy the company for.

CLAY: Yeah. And, Buck, I think it’s also emblematic of — to your point on the overevaluation of Twitter. So many stocks and companies have tanked as a result of the Joe Biden inflation and all of the challenges currently existing in our economy right now. It’s funny how quickly Twitter went from, “Oh, this is an existential threat to our company,” to now suing, demanding that Elon Musk purchase the company for the price that he agreed to buy the company for.

Because the reality is they had an opportunity to go out to the open market and say, “Okay, Elon has offered $54.20 a share. Who also is gonna put a bid in?” No one did. And now the stock price is $20 below where Elon offered. If this completely falls apart, stock price goes back down into the twenties, and so I think they’re going to come to some sort of agreement at a lower price where Twitter acknowledges that some of the data that it has provided has not been a hundred percent accurate.

And Elon says, “Okay, I will still purchase it,” I would bet somewhere in the $38 to $42 range, if I were betting. Other possibilities… Again, we talked about specific performance. I don’t see it. I think Musk would end up having to pay several billion dollars in damages in order to get out of this deal. I think they agree to a price in the $38 to $42 range.

BUCK: You still think he buys this it, though —

CLAY: Yes.

BUCK: — because I’m wondering if this in some way turns into years of litigation?

CLAY: It’s a money pit? I think that Delaware, they will resolve it within this calendar year. They typically have the sophisticated judges. Because so many companies are based there, they understand that time is of the essence in these court proceedings. So I don’t think this is the kind of case that drags on for two or three years. I think before the end of this year there will be a resolution.

BUCK: That’d be great because if Elon doesn’t buy Twitter, I don’t know how our Twitter experience is gonna go, Clay, once they start locking down parts of New York City again with the next variant — or not locking down, really, but mask mandates and all the rest of it. They haven’t. They haven’t backed off all this stuff. They haven’t decided that it’s all over.

I don’t just mean the covid things. It’s not like Twitter has agreed that they should stop censoring people. They haven’t agreed to that at all. They’ve decided to double down and tell everybody, “Yes, we think that there are responsible things that people can say on contentious political topics and there are things that you’re not allowed to say,” also known as being a conservative. So there you go.

CLAY: Remember when we were adding tens of thousands of Twitter followers in the immediate aftermath of Elon announcing that he was gonna buy Twitter and suddenly they stopped regulating?

CLAY: Remember when we were adding tens of thousands of Twitter followers in the immediate aftermath of Elon announcing that he was gonna buy Twitter and suddenly they stopped regulating?

BUCK: That was not because so many new people were signing up for Twitter, by the way, which was the storyline they told. It was they made a shift in the back end of the algorithm that allowed people to have full and organic reach — and that was a game change those of us who are operating there. We are always swinging the bat with the doughnut on it. That’s what’s it’s called, right?

CLAY: Yeah. That’s right. That’s a good sports analogy.

BUCK: Thank you, sir.

CLAY: And it has since vanished, right? I don’t know about you, but, like, when I look and go and check and see my follower account, it hasn’t really budged very much in the past several weeks, compared to what happened in the immediate aftermath of Musk potentially buying Twitter. And I think what was happening there was all the data analysts were scrambling to try to take all of the inappropriate filters and regulations — the doughnut on the bat, so to speak, in the analogy you just made — and they’re now trying to get back to some form of normalcy. It already seems like that normalcy has vanished and we’re back to far left-wing Twitter all over again.

Recent Stories

Political Commentator Debra Lea Talks the Mood in Israel and the Deadline for Iran

Just back from Israel and with an eye on Iran, Debra starts by making a point: She's not in the Mossad.

President Trump Says We May Just Do a “Friendly Takeover” of Cuba

Capitalism, and President Trump, can make Cuba great again (especially if the Supreme Court rules that the communists have to give back all they stole).

We Would Never Cover Up for People Accused of Epstein’s Crimes

If you think members of the administration are covering up for heinous acts against children, you're wrong.

Manufacturing Delusion Is On Sale Now!

Buck's book opens at #4 on the New York Times bestseller list. Get your copy today!

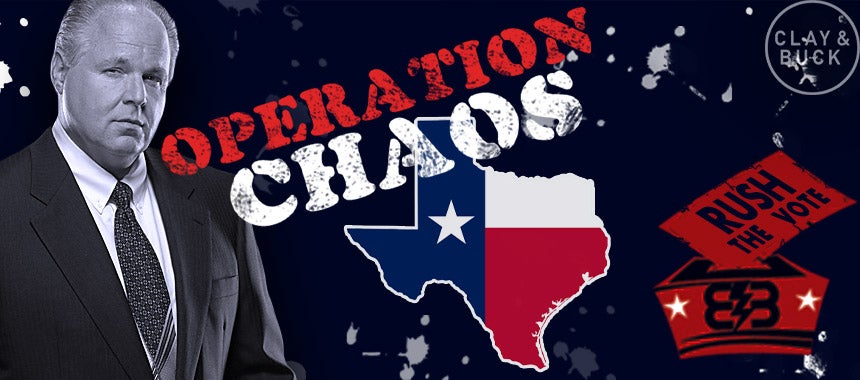

Operation Chaos Lives in Texas! Republicans Voting Crockett?

Rush's Operation Chaos reborn in the Lone Star state!