Biden’s Tax on Unrealized Gains Will Impact Everyone

26 Oct 2021

BUCK: I gotta say they’re trying desperately to sell this Biden plan. What people were saying days out now it’s making a lot of rounds. “Hold on. So you’re just gonna tax the billionaires’ unrealized gain? You’re not gonna tax, say, the unrealized gains of 401(k) plans? You’re not gonna do that, right? You’re not gonna all of a sudden start saying, well, you know, everybody who has a certain amount that’s in there?”

CLAY: Buck, this is the story of the Internal Revenue Service, right? Initially they only taxed the super wealthy, and they said, hey, this is not going to impact us at all, meaning the common folks, right? And as soon as you implement a new paradigm — I mean, there are a lot of people right now sitting on homes that have increased substantially in value, right? Lets you bought a house for $300,000, which I bet, you know, a decent number of our listeners might have. And you’ve had that house for a decade now, and now it’s worth $600,000. What if the government decides that you’re going to have to pay taxes on that $300,000 in increased home value that you got? This is a brand-new dynamic.

Again, I think this is going to be played out in the courts because it’s unclear whether the federal government has the ability to tax unrealized capital gains. And again I think we need to make people understand here this is paper profits. This is if you bought a stock and you held it, it’s now at $20, in theory if you sold it, you would make that money, but until you sold it, it’s all on paper. This is what they’re gonna start to do. If they will tax the billionaires, trust me, it’s gonna come to the millionaires, and sooner or later, just like the tax code itself, it comes for the regular Joes like you and me and Buck and everybody else out there.

BUCK: That’s where the revenue is. You know, it’s folks who are working and paying their bills in the aggregate, that’s where the real squeeze is. That’s where the government can get the most amount of bang for their buck, so to speak, by going after the masses of people. You could seize every dollar that these billionaires have. It’s not gonna fund the government. And I’m not even talking about their unrealized gains. You could take the richest .0001% of Americans, whatever it may be, and seize all of their assets, and guess what? You still would not be able to fund all these federal government programs. It wouldn’t take care of the almost $30,000 trillion now we have in the national debt. But Biden’s still out there whispering to you because ,(impression) “If he whispers, if he whispers, it’s gotta be true. ” He telling you it’s a tax cut he is pushing. Play 13.

BIDEN: Everybody talks about the children and Josh has heard me say it. I view it as a tax cut for middle-class families, a tax cut. We never have an argument when we talk about the wealthy. This is a tax cut. It changes the lives the American people.

BIDEN: Everybody talks about the children and Josh has heard me say it. I view it as a tax cut for middle-class families, a tax cut. We never have an argument when we talk about the wealthy. This is a tax cut. It changes the lives the American people.

BUCK: I mean, he can call it a hippopotamus if he wants. Doesn’t make it true. It’s not a tax cut plan. That’s not what he’s pushing. That’s not what this program, this bill is all about.

CLAY: It’s a massive wealth tax, and for anybody out there who is a student of history, that’s how our income tax started. The idea of roughly a hundred years ago was, we’re only going to income tax the richest among us. That was the idea. Once this policy becomes a reality, I’m just telling you, I think there’s a very good chance that more and more people find themselves caught up in this wealth tax, and sooner or later it ain’t a wealth tax, it’s just a tax.

And again I’m not that confident, Buck, on the implementation ability, whether it’s constitutional, first of all, to tax unrealized capital gains. Secondly, I’m not confident that the federal government is going to be able to put forth a policy that the best accountants and the best tax lawyers are not going to be able to exploit such that they’re not actually going to be able to run a functional part of the government here.

BUCK: And think about also what this will mean for people that have family farms for generations, right? You might have a couple of hundred acres that you’ve been farming. Well, if that real estate value may have increased substantially. So are you gonna be exempted from this? But it just means there will be endless carve-outs and manipulation and jockeying for favorable treatment within this new unrealizedgains component of the tax code and so what you’re saying, Clay, yeah, the billionaires, they’re always gonna find a way. They will move their assets to another place, to another area, another realm where they are shielded or they just won’t be the investing, you know, the same way. They’ll have a very different approach. Whereas, you know, the person that has a family house that may be has doubled in value over 20 years or 15 years or whatever, what happens to them? You know, you got this half million-dollar house now that you’ve got, and you gotta pay unrealized gains on that? Where does that money come from?

BUCK: And think about also what this will mean for people that have family farms for generations, right? You might have a couple of hundred acres that you’ve been farming. Well, if that real estate value may have increased substantially. So are you gonna be exempted from this? But it just means there will be endless carve-outs and manipulation and jockeying for favorable treatment within this new unrealizedgains component of the tax code and so what you’re saying, Clay, yeah, the billionaires, they’re always gonna find a way. They will move their assets to another place, to another area, another realm where they are shielded or they just won’t be the investing, you know, the same way. They’ll have a very different approach. Whereas, you know, the person that has a family house that may be has doubled in value over 20 years or 15 years or whatever, what happens to them? You know, you got this half million-dollar house now that you’ve got, and you gotta pay unrealized gains on that? Where does that money come from?

CLAY: No doubt. It is going to be a monster issue.

Recent Stories

Political Commentator Debra Lea Talks the Mood in Israel and the Deadline for Iran

Just back from Israel and with an eye on Iran, Debra starts by making a point: She's not in the Mossad.

President Trump Says We May Just Do a “Friendly Takeover” of Cuba

Capitalism, and President Trump, can make Cuba great again (especially if the Supreme Court rules that the communists have to give back all they stole).

We Would Never Cover Up for People Accused of Epstein’s Crimes

If you think members of the administration are covering up for heinous acts against children, you're wrong.

Manufacturing Delusion Is On Sale Now!

Buck's book opens at #4 on the New York Times bestseller list. Get your copy today!

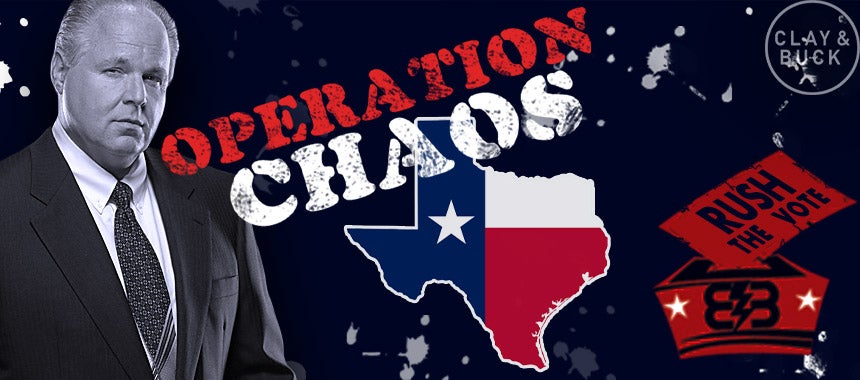

Operation Chaos Lives in Texas! Republicans Voting Crockett?

Rush's Operation Chaos reborn in the Lone Star state!